Amid the economic downturn, abundant opportunities for financial institutions are similarly attracting more sophisticated fraud that requires curtailing: study .

In the current pandemic turmoil, cybercriminals are targeting financial institutions (FIs), and their increasing sophistication has caused three countries in the Asia-Pacific region (APAC) to ramp up fraud prevention measures to the tune of around US$100m, according to a recent report by GBG.

As FIs vie for digital confidence with their target consumers, 66% of respondents cited end-to-end fraud management platform readiness as a key differentiation to driving preference.

However, only 6% cited having an existing implementation of an integrated end-to-end fraud and compliance platform solution, and vertical siloes were still seen in 43% of APAC FIs, mostly in digital banks. Upgrading to fraud management platform solutions was also a work in progress for 57% of FIs and almost 50% had plans to upgrade their digital onboarding fraud solutions.

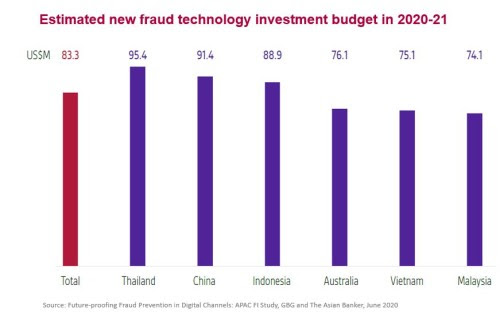

The 324 FIs polled across Australia, China, Indonesia, Malaysia, Thailand and Vietnam projected an average estimated budget of US$83.3m to purchase new fraud prevention technology between 2020 and 2021. The three countries with the highest average estimated fraud budgets were Thailand (US$95.4m), China (US$91.4m) and Indonesia (US$88.9m).

The study has unveiled FIs’ apparent interest in new segments beyond the traditional white- and blue-collared workforce. As financial technology advances, the unbanked segment has pivoted to be a mainstream focus in sync with fraud technology advances, with almost a third of respondents planning to access the unbanked (32%) and underbanked (31%).

Financial Crimes 4.0?

According to GBG’s APAC MD June Lee: “Looking at 2020-2021, the COVID-19 pandemic will continue to push people and businesses to take digital-first approaches to financial transactions. From our research, e-wallet, instant financial services, mobile and app banking are going mainstream rapidly, which make it urgent for FIs to take innovative and proactive measures to future-proof against escalating digital financial crimes.”

According to Lee, the pandemic is creating a lot of uncertainty, but the majority of FIs in APAC recognize that “an end-to-end fraud management platform is strategic to differentiating themselves from the highly-disruptive landscape they are playing in, and would be a springboard to scale fraud prevention and securing digital trust with customers.”

GBG has coined a term—Financial Crimes 4.0—for the mega risk trend covering the heightened complexity and growing volume of emerging financial crime arising from Industry 4.0. This includes the boom in digitally-connected devices, Internet of Things and online social sharing which have opened new access points and vulnerabilities for exploitation by malicious actors.

As FIs cash in, cash outlays also needed

According to the report, instant gratification for finance and banking services is seeing greater demand and rollout by financial institutions in APAC, with 31% of FIs planning for instant bank account applications and instant loans, and 29% of FIs planning rollouts of instant credit cards. Furthermore, financial products like e-wallets are becoming a hygiene factor for 90% of financial institutions as they look to expand their digital channels and deliver superior customer experiences.

While FIs may jump at the opportunities presenting in the current economic climate, respondents in the GBG study recognized all fraud typologies were on the rise. Social engineering crimes, in particular, raised even more concern than typical scams. Respondents believed that they require stronger endpoint threat prevention solutions to work across the onboarding and transaction customer journey. The need for enhanced data intelligence to obtain a better 360-degree view of a customer also saw an uptick, with more than 50% of respondents planning to invest in the ability to ingest new data in 2020-21.

GBG’s APAC CTO Chee Leong Chin added: “The proliferation of personally identifiable information (PII) is making consumers increasingly vulnerable and susceptible to fraud and identity crimes. Meanwhile, customer expectations around instant access to an increased variety of digital financial services and digital safety assurance in transacting online are also skyrocketing.”