Banks are taking steps to protect their customers, so a financial superapp has also followed suit — using AI/ML to intervene.

The producers of a global financial superapp had found that in 2023, 59% of all money lost to app scams on its platform originated from investment scams. Conversely, ‘purchase scams’ were the most common type of app scam, comprising 62% of global scam cases analyzed across the same period.

Now, the maker of the superapp — Revolut — has incorporated AI and machine learning to detect if a customer is being scammed, and it will intervene before the customer can send money to fraudsters.

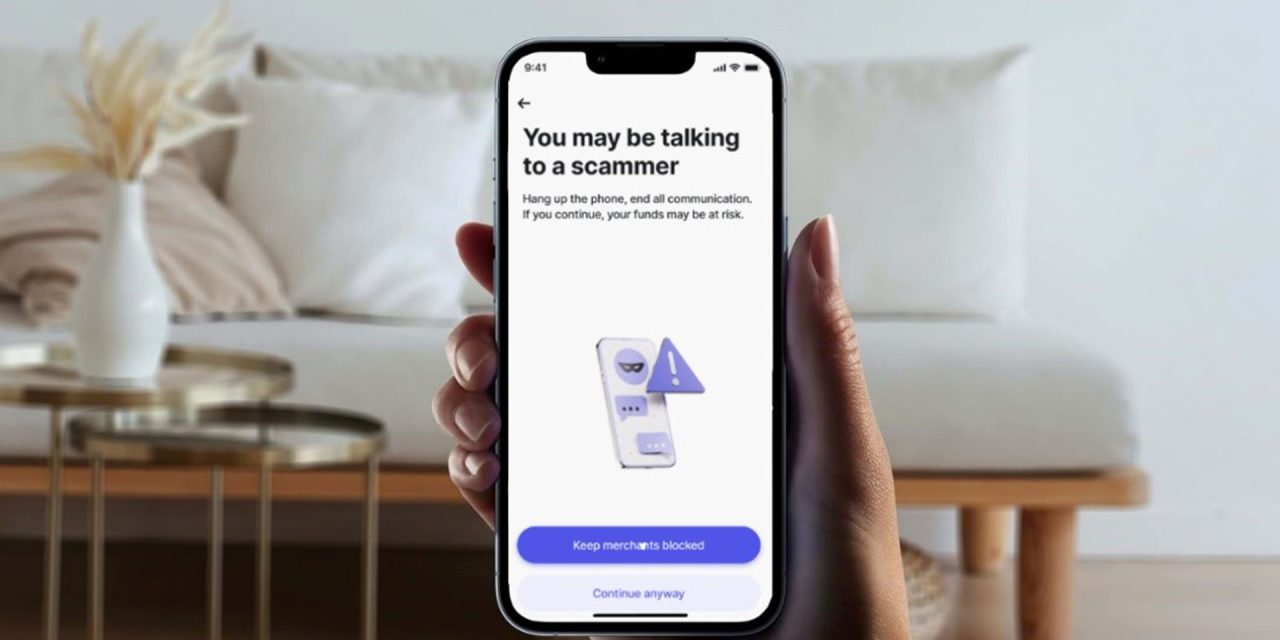

The new feature is set up to determine if there is a high likelihood that the customer is making a card payment as part of a scam, and if so, decline the payment. Next:

- The customer is protected from performing other similar payments and sent through a “scam intervention flow” within the app. During this phase the customer needs to provide some additional information about the transaction being attempted, with the goal being to check whether the customer is under a scammer’s spell and guidance.

- Then, the customer is shown specific scam educational stories to be reminded to think in-depth before making the payment.

- The app can also redirect the customer into a chat with a fraud specialist online, who will then ask the customer further questions in order to determine what other advice is needed.

The firm has observed that, since the launch of the scam detection feature, there has been a 30% reduction in the fraud losses resulting from card scams on its platform.

Said its Head of Fraud, David Eborne: “We’ve spent months innovating and testing the product to ensure that customers can continue to spend and send their money safely. With this advanced feature, rather than completely block those transactions, we ensure that customers who want to perform legitimate payments continue to do so, but also intervene to protect those who are being guided by criminals to make fraudulent ones. We are giving our customers both freedom and security at the same time.”