Financial market infrastructures are also intricately linked to the vulnerabilities identified in a white paper by a clearing/settlement services firm.

In a follow-up to a 2015 white paper warning of the need for risk managers in the financial services industry to view the global financial system as a complex network of interdependent factors that could be broadly destabilized via the failure of a single, large entity, the Depository Trust & Clearing Corporation (DTCC) has highlighted four new emerging risks.

As the nature of risk continues to evolve and black swan events occur with greater frequency, recent developments that require heightened scrutiny among risk managers include:

- Countries that rely heavily on foreign capital are more vulnerable to systemic shocks due to greater cross-border financial exposures

- Distributed ledger technology and the growth of cryptocurrencies are becoming increasingly interconnected with other parts of the financial ecosystem

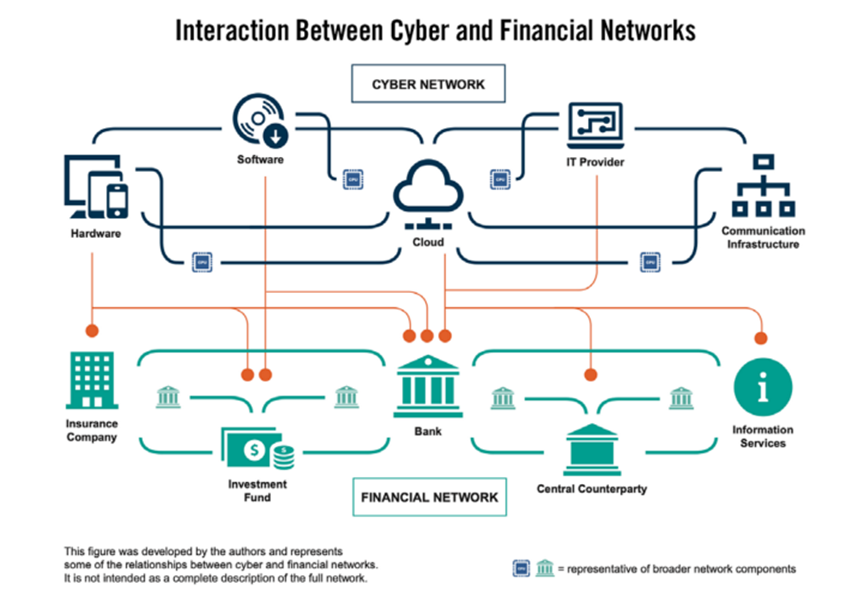

- Increased reliance on third party vendors and the rise in the volume and sophistication of cyberattacks is exacerbating operational risks

- Non-Bank Financial Intermediation is another growing channel of risk transmission

As Financial Market Infrastructures (FMIs) are interconnected with the financial ecosystem and face their own risk management challenges, the DTCC has taken initiatives including:

- Implementing agreements between DTCC’s clearing agencies and other FMIs to reduce the risk associated with a common member’s insolvency

- Establishing a cross-functional initiative to address risks related to interconnected entities

- Developing a comprehensive framework to identify, monitor and manage risks posed by links between clearing agencies, financial market utilities or trading venues

According to the firm’s Managing Director and Chief Systemic Risk Officer, Michael Leibrock: “Given the increasing complexity of the global financial system, it is more crucial than ever that firms continue to evolve their approach to managing risk, ensuring they’re taking a holistic, comprehensive view of all the relevant factors.”

To tackle the complex risk environment, the industry should adopt a multi-disciplinary approach that leverages insights from a diverse group of subject matter experts while ensuring close coordination between stakeholders through constant collaboration and sharing of intelligence and feedback.