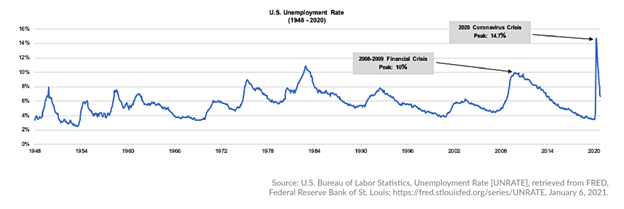

…but post-traumatic market stresses and risks could be lurking and bubbling, warns a white paper by a post-trade financial services giant.

Despite the pandemic, financial markets performed remarkably well in 2020 amid unprecedented market volatility and record trade volumes. However, the considerable impact on the global macroeconomic environment and systemic vulnerabilities will likely cause structural changes to the financial services industry and also the regulatory landscape and legislative agendas.

This, according to Depository Trust & Clearing Corporation (DTCC), means that financial market infrastructures (FMIs) should focus on some key priorities in the coming years to proactively and effectively manage risk in a post-pandemic environment.

FMIs play a crucial role in safeguarding global financial stability, and the key priorities, going forward, include:

- factoring the lessons learned from the impact of the pandemic on FMI risk management regimes into risk models.

- providing greater margin transparency to help clients navigate extreme volatility in crisis situations involving margin procyclicality.

- taking an enhanced sector-specific approach to managing credit risk to improve assessment of the impact on individual counterparties.

- constantly reassessing clearing members’ available liquidity, which can deteriorate quickly in periods of market stress.

- continuing to monitor and manage new operational risks due to extended remote-working environments that have higher risks in cybersecurity, third-party dependencies and other aspects.

The firm also notes that the longer-term effects of the pandemic will likely reverberate through the financial industry for years to come and could weigh on the financial sector’s profitability, potentially contributing to further consolidation within the industry. Its Managing Director and Group Chief Risk Officer Andrew Gray said: “Extreme events such as the COVID-19 pandemic illustrate and reinforce the importance of an unwavering commitment to risk mitigation and resilience across the industry. While FMIs continued to perform as expected throughout unprecedented market turmoil, risk management practices must continue to evolve.”

As the pandemic continues on its trajectory, FMIs should constantly reassess clearing members’ available liquidity, which can change quickly in times of stress, Gray noted in his firm’s white paper.