Pssst, banks are terrified of this sure-win investment scheme. Sign up now: your favorite celebrities did, and they are now rich!

Thousands of personal records of users from the UK, Australia, South Africa, the US, Singapore, Spain, Malaysia and other countries were exposed in a targeted multi-stage bitcoin scam discovered recently.

Phone numbers, which in most cases came with names and emails, were contained in personalized URLs used to redirect people to websites posing as local news outlets with fabricated comments of prominent local personalities about a cryptocurrency investment platform that “helped them build a fortune”. The source of the leak has not been established yet. The information has been provided to relevant authorities in the affected countries by threat hunting and cyber-intelligence firm Group-IB.

An investigation by the group revealed that 248,926 sets of personally-identifiable information were exposed in what turned to be a complex three-stage scam designed to drag people into a shady bitcoin investment scheme. The analysis of the exposed phone country codes showed that most of the victims were from the UK (147,610), followed by Australia (82,263), South Africa (4,149), the US (4,147), Singapore (3,499), Malaysia (2,491), Spain (2,420), and other countries.

Preying on celebrity influences

The new scheme is similar to a previous “Bitcoin Evolution” scam that Group-IB had also reported on in February this year—with one big difference—this time, a massive amount of victim’s sensitive info was exposed. Group-IB’s team was able to identify all the stages of the fraud from its entry point to the last phase.

First, a victim receives a text message. Scammers sometimes send out phishing messages using the name of a recognized media outlet as the sender. Every message contained a unique short link. Further analysis of the URLs revealed that the short link takes a victim to another URL which already demonstrates their personal data, such as the phone number, first or/and last name, and sometimes an email address, and used for redirecting victims to fake websites masquerading as a local media outlet.

The researchers have run the exposed info through data breach repositories and have analyzed several underground marketplaces for the presence of this data but no traces of the exposed info were found. The experts believe that the personal information info could have been obtained by fraudsters through a separate fraudulent scheme or simply bought from a third party.

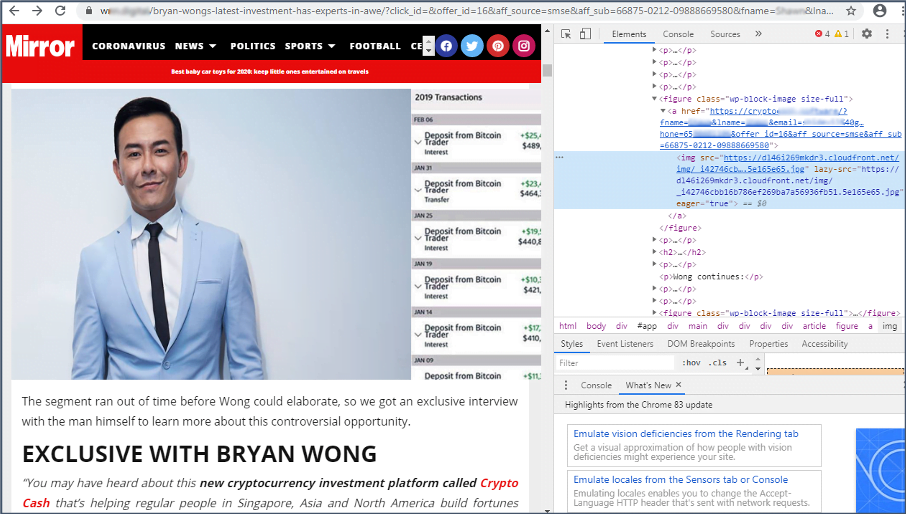

The content a user would see often depends on their location. For example, users from the UK would be demonstrated a website disguised as the Sun or the Mirror; Australians would likely see a fake ABC Australia website. However, all the websites feature similar made-up interviews and fabricated comments attributed to local celebrities whose names were hijacked by the scammers: Bryan Wong, Chris Brown, Andrew Forrest, Travers ‘Candyman’ Beynon, Gina Rinehart, and others.

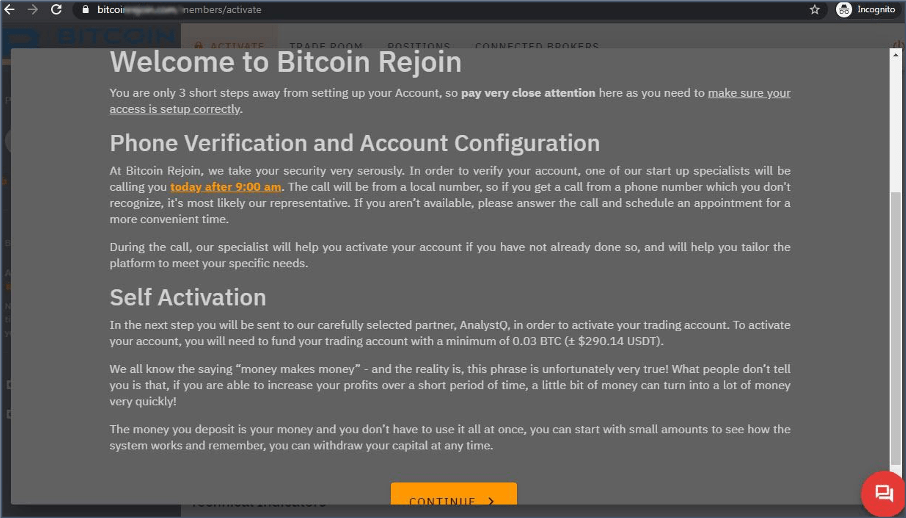

All these fake articles allege that famous people made a fortune thanks to the new cryptocurrency investment platform. All the fake pages discovered are almost identical in terms of design, but the URL and the page code are unique every time and contain users’ personal records. If victims decide to click any link in the article, they are taken to a bitcoin investment platform website, where their data, contained in the URL, would already be pre-filled in the registration form without a user’s consent. Later a victim would be asked to add to their account balance in BTC.

Same scam, different platform

Group-IB researchers have spotted six active domains featuring the same bitcoin investment platform that operates under different names: Crypto Cash, Bitcoin Rejoin, Bitcoin Supreme, and Banking on Blockchain. The findings have been shared with the relevant organizations in the affected countries for further investigation.

Said Ilya Sachkov, CEO of Group‑IB: “The bitcoin investment scams have been around for quite a while and we regularly detect new instances of crypto fraud. This time, however, the scheme was significantly upgraded, and a tremendous amount of personal information was leaked. The bad guys got smarter in a bid to increase the success rate of their fraudulent operations. Using personal data allows them to carry out targeted attacks and make a victim’s journey easier and smoother, which levels up the overall effectiveness of the scheme.”

In general, many people tend to underestimate the risks of their names, phones or emails circulating online until bad things happen, continued Sachkov. In fact, “such a huge amount of sensitive data in the wrong hands opens up a whole new world of opportunities for fraudsters. This data can be sold further, or they can push a new round of fraud.”

Expensive reputational damage

Regular users are not the only ones who suffer from these scams. Media brands and celebrities whose names were hijacked by fraudsters suffer reputational damage. According to market researchers, nearly 64% of users who have faced brand abuse online will never return to that brand—their trust in it has been undermined.

For celebrities, these cases can cause significant loss in the audience’s trust, which affects the sustainability of business relationships with their advertisers.

According to the group, complete visibility of the scheme is the key to eradicate this type of fraud. Media and celebrity names are mentioned on separate stages of the scheme and blocking them will not have an effect. Just like with the Rabbit Hole fraud, the cybercrooks can quickly rebuild the blocked parts and continue their fraudulent operations.

Effective monitoring and blockage should involve automated machine-learning powered brand protection system fueled by the regularly-updated knowledge base about cybercriminals’ infrastructure, tactics, and tools.