Here is a primer and refresher for readers who need a quick overview of common fraud tactics, and cyber hygiene tips

With advanced AI technology, it is now much easier for criminals to syphon off substantial sums of money from individuals and exact reputational harm on institutions.

To ensure that adequate security measures are established, it is crucial for organizations to know about the various types of fraud being committed by malicious individuals and syndicates.

Following are some of the more common types:

Phishing attacks

Criminals can gain login credentials through the use of fake emails, texts, or phone calls. Typically, the account holder is lured into providing their account details to someone pretending to be a bank staff member. This is what is commonly known as phishing.

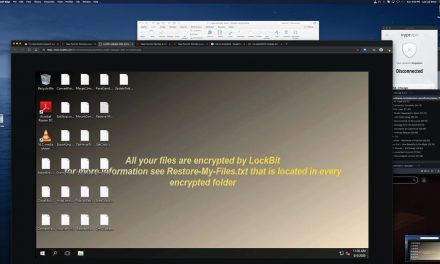

Credential stuffing

This type of scam is used by criminals who purchase stolen credentials off the Dark Web. The data is usually incomplete, so the attacker uses software to “stuff” user IDs and passwords into different login pages in large quantities, hoping for a match. Success rates are low, but attackers will try to work with large volumes of data to achieve their aim.

Session hijacking

The criminal will seize control of a customer’s ongoing online session through stolen session cookies. Stolen data is usually acquired through third-party browser extensions, devices infected with malware, or public Wi-Fi networks.

Password spraying

Instead of focusing on getting the right login information, hackers could use bots to match various usernames with commonly used passwords. This operation is done at a large scale, so hackers can ultimately hit upon some correct combinations and obtain access to accounts.

New-account fraud

Existing bank accounts are not the only ones vulnerable to attacks. Another concern is the potential consequences of new-account fraud. In this scam, the criminal could use another person’s identity to create a new account, or they could take it a step further by blending authentic and bogus identities to form a deceptive account. The criminal will most probably use counterfeit IDs, email addresses, or cheques to achieve this illusion of authenticity.

Basic cyber hygiene practices

This is what organizations can do to reduce bank fraud:

Stepping up regular user education and refresher training

One of the most powerful security methods available is educating staff and customers about typical fraudulent schemes. One example is to include warnings in transactions and email messages. These warnings can serve as reminders to help recipients distinguish between what is authentic and what could potentially be a fraudulent scheme.

Use multi-factor authentication and tamper-proof it

This authentication scheme requires multiple forms of identification such as biometrics and passwords, combined with something they possess, such as a key fob or a device that creates a unique code (digital token). To reduce phishing risks after criminals managed to circumvent one-time passwords sent via SMS (which can be intercepted in various scams), banks worldwide are progressively moving to more tamper-proof multi-factor authentication.

Enforce policy-based access control

This method enhances security by allowing entry only which established guidelines are adhered to. Authorization is contingent on the bank’s selection of authentication criteria such as job position, level of access, and period of time, geographical location, in order to grant pre-defined levels of data access.

Online safety is a daily culture

Ensuring online security online is not a one-time affair, and there is no way to “set it and forget it.”

Therefore it is important for leaders to continually update security measures in order to provide users with the required protection level.

Building trust between clients and banks is essential for preventing bank fraud. By adhering to these strategies and staying vigilant for new attack techniques, everyone can work together to prevent operational disruption and financial damage from cybercriminal activities.