By adopting a third-party identity security platform, the Indian financial institution expects to leverage zero trust principles amid growing cyber exposure

Through a network of over 1,000 branches in India, RBL Finserve provides financial services for millions of customers, with an especially strong presence in economically vulnerable communities.

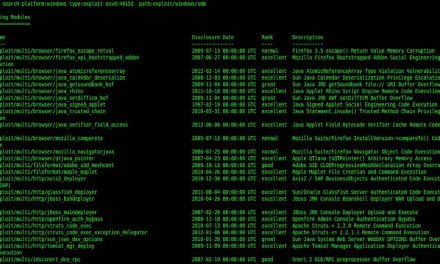

Over the years, the firm’s increased reliance on third-party services, cloud computing and remote-working technologies has meant that perimeter-based cybersecurity was no longer a viable model to protect a growing number of identities. Its security team was also determined to boost its ability to guard against consistent and massive password leaks sold on the Dark Web.

Therefore, in order to boost cyber resilience, safeguard customer data, and ensure business continuity amid a rapidly evolving threat landscape, RBL Finserve was announced on 5 Sep 2024 to have engaged an identity security platform built on zero trust principles.

According to the firm’s Chief Information Officer, S K Mohanty, the platform has enabled his firm to “integrate a security-first mindset into its digital transformation initiatives. We have attained a new benchmark for digital trust and safety.”

Specifically, the firm has implemented a privileged access manager, as well as a workforce identity module offered by the platform. The tools now allow the firm’s IT teams to manage administrators’ privileged access by isolating and monitoring sessions, while continuously rotating credentials. Additional features enabling Single Sign-On sessions and adaptive multi-factor authentication are also an essential part of the firm’s foundation planning to expand intelligent privilege controls across all human identities that access its systems, including third-party vendors.

According to Rohan Vaidya, Area Vice President (South Asian Association for Regional Cooperation & India), CyberArk, the firm that markets the identity security platform: “We are honored to be chosen by RBL Finserve to bolster their identity security… with intelligent privilege controls to protect customer data as well as the systems and processes that serve millions of households and businesses.”